Last updated: 20250203

Copy trading is a popular and innovative trading strategy that allows traders to automatically copy the trades of experienced traders. It has gained considerable popularity due to its simplicity, potential for profit and ability to easily trade different financial markets (such as Forex, Shares, Stock market index and Cryptocurrency CFDs).

In this detailed guide, we will explore what Copy trading is, its benefits, risks, how to find traders to copy, and much more.

What is Copy trading?

Understanding the concept of copying another persons trade5

Trade copying services are a form of Social trading where investors can copy the trades of other successful traders, generally via a Contract for difference (CFD). It involves connecting your trading account to a Copy trading platform or app, selecting the trader/s you want to copy, and the software application then automatically replicates their trades in your own brokerage account#.

This allows inexperienced investors to leverage the expertise of more seasoned or professional traders by copying trades automatically in real-time (using an Automated trading system), and potentially achieve similar returns.

What is the difference between Copy and Social trading?

Social trading involves the use of social networks for traders to interact with each other, share their strategies, and discuss market situations. It’s akin to a digital marketplace where traders exchange ideas and insights to enhance their trading strategies. A trader in this setup can either follow a peer’s trading strategy or devise one on their own based on the market insights gathered.

On the other hand, Copy trading is a subtype of Social trading that allows traders to copy the trades of experienced and successful traders automatically. In this model, when the trader being copied executes a trade, the same trade is replicated in the account of the trader doing the copying. This approach is more passive, as traders don’t need to make individual investment decisions.

Therefore while both Social trading and copying experienced traders offer benefits such as reducing market research time, and leveraging experienced traders’ strategies, they do differ.

Benefits of copying other traders

Copy trading has becoming increasingly popular among investors of all levels of experience, no matter what Financial market they wish to trade.

A significant appeal lies in its simplicity and accessibility. It offers an excellent entry point for novices who might otherwise be overwhelmed by the complexities of the financial markets. By copying the strategies of expert traders, beginners can dip their toes into the markets without needing to grasp all the nuances, or developing their own trading strategies, from the get-go.

Secondly is the time-saving aspect. Traditional trading involves constant market research, monitoring and fundamental or technical analysis which can be time-consuming and challenging for many. When copying a trade, these responsibilities lie largely with the trader being copied, thereby reducing the time investment needed.

Another benefit is the potential for diversification as copy traders can follow multiple traders simultaneously, each likely to trade different assets in different markets. This creates a diversified portfolio which could reduce risk as it’s less likely that all investments are on the same financial instruments at the same time.

It also eliminates the emotional aspect as trades are executed automatically based on the actions of the copied trader. Trading psychology involving fear, greed, hope, excitement, frustration (and the list goes on) is a critical aspect of being consistently profitable over the long-term, therefore these aspects are removed when copying trades automatically.

Lastly, Copy trading offers a unique learning opportunity. By following an experienced trader’s strategies, novices can gain valuable insights into successful trading skills and strategies. Over time, this hands-on learning can foster their own growth as independent traders, if they are proactive in understanding the trades that are copied.

Cons of copying other traders

When investing, it’s widely accepted that no strategy is without its drawbacks. Copy trading, despite its numerous advantages, is no exception to this rule. It’s essential to examine its potential downsides so that you can make well-informed decisions.

One of the primary drawbacks of is the lack of control. Traders essentially entrust their investments to the strategies and decisions of others due to trades copied automatically. This lack of direct control can be unsettling for some, especially when markets become volatile.

Another disadvantage is the high level of risk for potential losses due to poor performance or erroneous judgement by the copied trader. While successful traders can provide fruitful returns, their strategies might not always prove successful. Every investor is human and prone to make mistakes, and those mistakes get replicated in a trade copy scenario.

The success of Copy trading depends heavily on choosing the right trader to follow. This requires substantial research and analysis, which may consume time and effort that some traders may not be prepared for or capable of. Sound investment decisions are based on detailed knowledge – both pros and cons. Ultimately, it’s crucial to know your Investor profile by assessing your own financial situation, risk tolerance, available time, trading goals and style before opting for any investment strategy.

How to start Copy trading

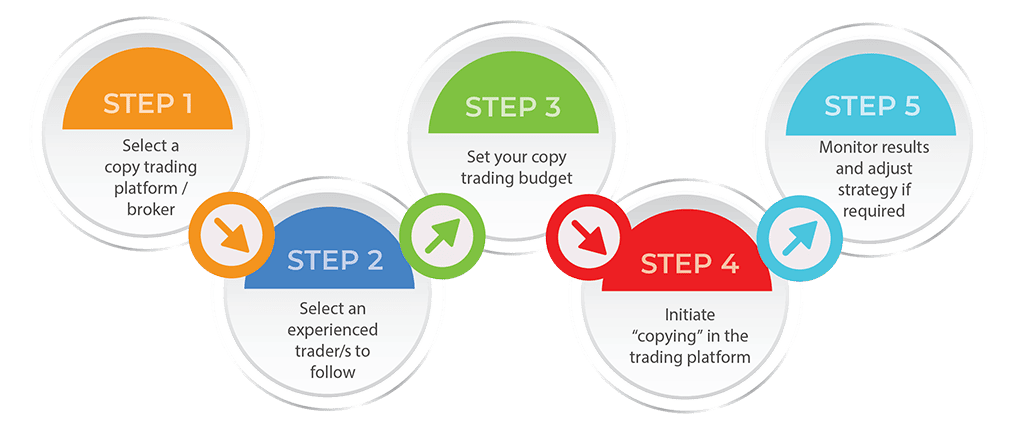

5 key steps to become a successful copy trader.

1) Select a Trading Platform / Broker

The first step is to to choose a reliable online Social trading platform, or broker whose platform supports Copy trading, with a good reputation to facilitate your copy trades.

You will then open a trading account# and setup your profile.

Two of the leading social trade platforms in 2025 are eToro and TD365. These platforms offer a user-friendly interface, a wide range of financial instruments to trade, and a large community of successful traders to copy via a Contract for difference (CFD).

2) Find a Trader to Copy

The second step is to choose an experienced trader with a successful track record (their “trading history”) and a trader style that aligns with your investment goals. We cover this in detail below when discussing factors to consider when selecting a trader to copy.

However, it is so important to fully evaluate the performance and trading history of the traders, before making your selection… don’t just pick one with the highest win rate as there is more to being consistently profitable than simply having a high win percentage.

3) Set Your Trading Parameters

The third step is to determine how much you are willing to invest in the trades and set your trading parameters (trade size, risk parameters including drawdown limits, etc). Always remember that your capital is at risk, past performance does not guarantee future results and never risk more than you can afford to lose.

4) Initiate Copying

The fourth step is to use the platform’s tools to start automatically replicating the trader’s positions in your own brokerage account.

5) Monitor and Adjust

The fifth step is to regularly review your portfolio and adjust your Copy trading strategy as necessary.

The best Copy trading platforms in 2025

Leading trading platforms to copy trades

eToro is widely regarded as a leading platform for Copy and Social trading. It has a user-friendly interface, a large community of successful traders, and offers a wide range of financial instruments to trade. The platform also provides a variety of tools and features to help traders optimise their trading experience.

TD365 is another leading broker offering a user-friendly copy trade platform. In addition they offer tight fixed spreads and single currency trading (you can trade everything in your chosen base currency), which simplifies your trading and saves on FX conversion fees!

Choosing the right broker for your trades

When choosing a copy trading app, software or platform, it’s important to consider the reputation and reliability of the broker. Make sure to select a broker that is regulated and has a good track record in the industry. This will help ensure the safety of your funds and a good range of traders (with long-term results) to potentially copy.

Exploring other popular copy trade platforms

In addition to TD365 and eToro, several other Copy trading platforms are available in 2025. These include ZuluTrade, NAGA, and Tradeo. Each platform offers unique features and a diverse community of traders to choose from. Before making a final decision, it’s recommended to compare the platforms’ features and offerings and try out their demo accounts to ensure they are intuitive for you.

Find the best traders to copy

Factors to consider when selecting a trader to copy

- Performance History: A trader’s past performance is not an indicator of future success, but it can provide insights into their trading skill and risk management. Consider their overall profitability, how consistently they’ve generated returns, and how they performed during market downturns.

Trading Style and Strategy: Some will focus on long-term growth while others seek short-term gains. Some favour high-risk, high-reward trades, while others prefer conservative strategies.

Evaluate their risk-reward ratio, win rate, and average trade duration. Understanding a trader’s style and strategy can help you select one that aligns with your financial goals and risk tolerance.- Portfolio Diversification: Look at the variety of assets in their portfolio. A diversified portfolio indicates that they are spreading the risk across different asset classes, which is usually a safer strategy than putting all eggs in one basket.

- Risk Score: Most Copy trading platforms assign risk scores to their traders based on their statistics and behaviours. A low risk score typically signifies a more cautious trader who might generate slower but steadier returns.

Conversely, a high risk score could mean potential for higher gains but at a greater risk. - Communication: Many successful traders on Copy trading platforms actively communicate with their followers, sharing insights about their strategies or explaining their trades. These people can be particularly valuable if you’re looking to learn from your trade copying experience.

- Frequency of Trading: Traders who trade infrequently might not provide as many opportunities for returns as ones who trade more often. However, executing frequent trades might also indicate high-risk day trading.

Using trading history to evaluate performance

Copy trade platforms will provide detailed history on each trader’s profile. It’s important to thoroughly analyse the performance metrics, such as percentage returns, maximum drawdowns, and average profits. This will help you identify consistently profitable traders with a sensible approach by considering their risk-reward ratio.

Never just look at the win percentage as a “guide” to the profitability of the account! Whether you trade only for yourself or using a Social trading platform, it is a trap to only consider the win rate in isolation and we can’t stress this enough!

For example, it is possible to show a win rate of 70%, for example, and still loose money because the loosing trades are so large compared to the size of the average winner.

The decision of selecting a trader to copy should be taken with due diligence. It’s advisable to spend considerable time researching and understanding potential traders before making your decision. Remember, every trader will have some losing trades – what matters most is their ability to generate overall profits over time!

Copying traders vs. Mirror trading

Understanding the difference between Copy and Mirror trading

While copy and mirror trades are both forms of Social trading, there are a few key differences between them. Copying traders automatically have the trades of a selected trader/s replicated in their own brokerage account, while Mirror trading involves automatically executing pre-designed trading strategies. This is a subtle but very key difference!

Pros and cons of Mirror trading

A Mirror trade strategy can be advantageous for traders who prefer automated trading strategies and want to follow specific pre-defined systems. It eliminates the need for manual trade execution and allows traders to take advantage of the expertise of professional signal providers. However, it may also limit flexibility and control over individual trades.

Choosing the right trading system for your needs

When deciding between Mirror and Copy trading (or any other form of Social trading), it’s important to consider your own trading preferences and goals. If you prefer to have more control over individual trades and want to learn from successful traders, trade copying may be the better option.

However, if you prefer automated strategies and want to follow specific systems, Mirror trading may be more suitable.

Tips for successful Copy trading

Setting realistic expectations

It’s important to set realistic expectations when copying the trades of other traders, or any trading service for that matter. While it can be a profitable strategy, trading is high risk and not a guaranteed way to make money! There are no guarantees with any financial investments or strategies, no matter what trading signals, app or strategy you use (even if you copy a trader with the very best results).

Market conditions and trader performance can change quickly, so it’s important to be prepared for potential losses.

Set realistic profit targets, never risk more capital than you can afford to lose, and always remember that past performance is not an indicator of future returns.

Managing risk for trades that are copied

Risk management is crucial for copy traders!

Diversify your portfolio by copying multiple traders with different trading strategies. This will help mitigate the potential risks of relying too heavily on a single trader.

Additionally, always set stop-loss levels to limit potential losses and protect your trading capital.

Combining Copy trading with manual trading

Many successful traders combine copy trades with their own manual trading strategies. This allows them to benefit from the expertise of other traders while still having control over their own trades. By diversifying their trading strategies, they can increase their chances of profiting in various market conditions.

To sum up, copying the trades of others serves as a powerful tool in a trader’s arsenal. Its simplicity, accessibility, and learning opportunities make it an appealing strategy for beginners while its time-saving and diversification benefits could also attract more experienced traders.

However, as with any investment strategy, it’s important to fully understand it before diving in – considering both its potential rewards and inherent risks.

Risk Disclosure: Futures, Contract for difference, Cryptocurrency and Forex trading, including Copy trading, contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardising ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Trading Style and Strategy: Some will focus on long-term growth while others seek short-term gains. Some favour high-risk, high-reward trades, while others prefer conservative strategies.

Trading Style and Strategy: Some will focus on long-term growth while others seek short-term gains. Some favour high-risk, high-reward trades, while others prefer conservative strategies.